Article Directory

I’ve been staring at two completely different pictures of “the market” all morning, and I think I’m going insane.

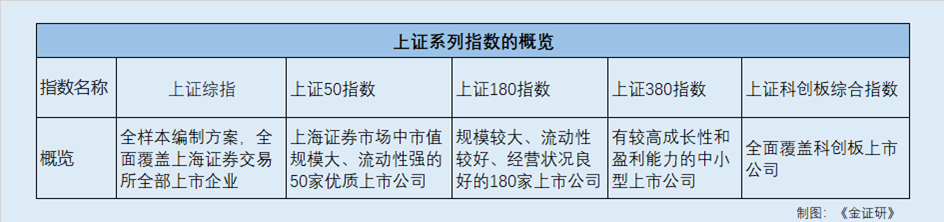

On one hand, you have this bulletin from the Shanghai Stock Exchange. It’s all polished corporate-speak about “optimizing” their SSE 180 Index. They’re tweaking the formula, adding “industry balance rules,” and even sprinkling in some ESG fairy dust to make their big, state-adjacent companies look more appealing. It’s meticulous. It’s controlled. It’s about as exciting as watching paint dry in a government building.

On the other hand, you have the crypto market. It’s a 24/7 digital casino fueled by memes, paranoia, and something called a “Fear & Greed Index,” which is basically a mood ring for people who think a cartoon dog on a coin is a viable retirement strategy. It’s pure, uncut chaos.

And here’s the kicker: They’re both the same damn thing. They are two sides of the same counterfeit coin, elaborate systems designed to manage your perception of risk while quietly fleecing you.

The Illusion of a Tidy Room

Let’s talk about Shanghai’s little project. They’re rolling out these changes on December 16, and the write-up is a masterpiece of bureaucratic jargon. They talk about enhancing "investability" and improving "sample market value coverage." They’re even introducing an ESG screen to weed out companies with a "C" rating or below.

Give me a break.

This isn't about creating a better, more representative index. This is about marketing. It’s about putting a new, Western-friendly label on a product that is fundamentally state-influenced. They’re trying to make it look safe, offcourse, like a pre-packaged meal that promises a balanced diet but is still full of preservatives. The "ESG sustainable investment concept" is the most cynical part. Are we supposed to believe that an authoritarian state has suddenly found its conscience? Or is it just another box to check to lure in global index funds that are run by algorithms and naive portfolio managers?

This is just window dressing. No, that's not right—it's building a whole new, fancier window frame for the same cracked pane of glass. They can talk all day about the Huaan SSE 180 ETF being the oldest and biggest, with its steady excess returns and juicy 3.48% dividend yield (华安上证180ETF投资价值分析:指数编制优化及增量资金流入 提升上证180指数投资价值). But what happens when the committee decides the "macro-industrial structural changes" require a different outcome? What happens when a company that’s a political darling suddenly gets a pass on its ESG score? You’re not investing in a market; you’re investing in the whims of its managers.

It’s the financial equivalent of a meticulously curated garden, where every plant is placed just so. It looks orderly and beautiful, but you know a team of gardeners is just out of sight, ready to rip out anything that grows in a way they don’t like. How is that a free market? And why would anyone trust that the gardeners have your best interests at heart?

At Least the Casino Is Honest About It

Now let’s wade into the crypto sewer. There are no committees here. There are no "preparation plan optimizations." There's just raw, unfiltered human emotion, broadcast for all to see.

The crypto world doesn’t pretend to be rational. It wears its insanity on its sleeve. They literally have an index that measures whether the herd is feeling fearful or greedy (Crypto Market Overview). Think about that. While the suits in Shanghai are backtesting Sharpe ratios, the crypto bros are checking a glorified thermometer to see if it’s time to panic-sell their Dogelon Mars tokens. At least it's honest. It admits that this whole thing is driven by sentiment, not by some grand, fundamental design.

This is the central difference. The SSE 180 is like a rigged carnival game where the operator assures you it’s all based on skill. Crypto is a back-alley dice game where everyone knows it’s rigged, but they play anyway for the thrill of it. Bitcoin dominance, trading volume, the endless parade of new altcoins—it’s all just noise and momentum. They talk about "fundamentals" in crypto, but everyone knows it's about catching the wave, and if you miss it...

I have to admit, there’s a twisted purity to it. The entire crypto ecosystem is a monument to the idea that value is whatever enough people agree it is, for however long they agree to it. The SSE 180 tries to build that consensus in a boardroom with spreadsheets and five-year plans. Crypto builds it on Discord with rocket emojis and laser-eyed profile pictures. Which one is more absurd? I honestly can't decide.

Then again, who am I to judge? People are making—and losing—fortunes in both. Maybe I'm just too cynical to see the genius in the madness, the method behind the spreadsheet and the meme. It just all feels like a show. It reminds me of those corporate "synergy" meetings where they spend hours rearranging the org chart, but at the end of the day, everyone's still doing the same pointless work. It's all just moving labels around a spreadsheet.

So Pick Your Poison

Ultimately, it doesn’t matter if your market is managed by a committee of bureaucrats or by the anonymous whims of the digital mob. One offers the illusion of stability, the other the illusion of infinite possibility. Both are narratives, carefully constructed to get you to put your money on the table. The Shanghai model is a slow, predictable waltz in a gilded ballroom. Crypto is a chaotic mosh pit at a rave. In the end, you're still just dancing to someone else's tune, hoping you don't get trampled when the music stops.