Article Directory

The Signal in the Noise: Why Today's Mortgage Rates Are a Glimpse Into Tomorrow's Economy

==================================================================================================

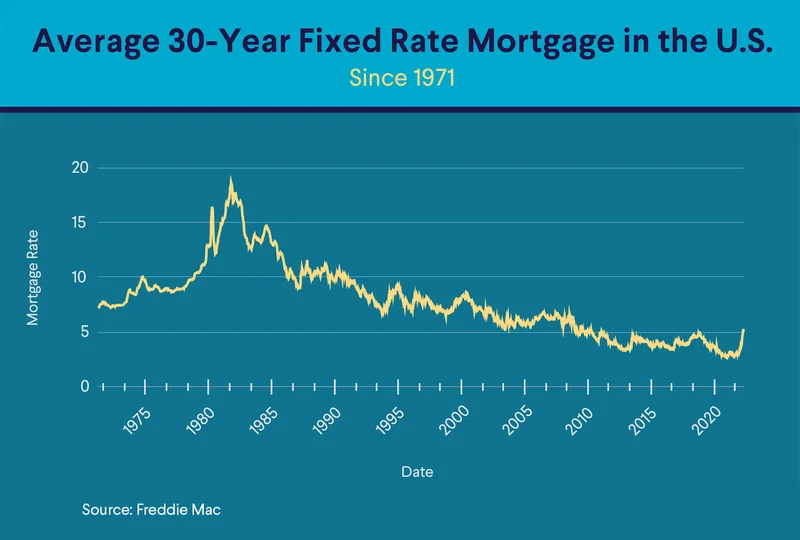

I’ve been staring at the numbers all morning. On the surface, they’re just data points on a chart. Headlines are declaring Mortgage Rates Today, Thursday, October 23: Finally Below 6%, and across the country, you can almost hear a collective, cautious sigh of relief. For anyone trying to buy a home or refinance, this is undeniably good news.

But if you look closer, past the immediate headlines, something far more profound is happening. I spent years at MIT learning to find the signal hidden within the noise, and what I see in today’s financial data isn’t just a market fluctuation. It’s a tremor. It’s the first faint signal of a fundamental paradigm shift in how we manage our economy. We’re not just watching interest rates today fall; we’re witnessing the dawn of a new philosophy of economic stewardship.

The End of Reactionary Economics?

For decades, we’ve operated on a reactive model. The economy overheats, inflation soars, and only then does the Federal Reserve step in to slam the brakes. Or, a recession hits, unemployment skyrockets, and the Fed belatedly starts cutting rates to clean up the mess. It has always been the economic equivalent of firefighting—waiting for the blaze to erupt before grabbing the hose. It’s necessary, but it’s chaotic and always leaves damage in its wake.

But what if that’s changing?

One economist, Sung Won Sohn, described the Fed’s latest moves not as a reaction, but as an “insurance cut.” When I first read that phrase, something just clicked for me. It’s not about the 25 basis points; it’s about the philosophy behind it. This isn't a panicked response to a crisis; it’s a calculated, proactive maneuver designed to give the economy “more room to grow” in the face of a slowing job market. This is the kind of systemic foresight I've spent my career advocating for in the world of technology.

Think about the leap from reactive medicine—only treating you when you’re sick—to proactive wellness, which focuses on nutrition, exercise, and preventative care to keep you from getting sick in the first place. This is what we’re seeing now. The Fed isn’t just reacting to yesterday’s problems; it’s anticipating tomorrow’s challenges—and that is a profound change in thinking. It means our central bankers are finally looking at the economy not as a simple machine to be fixed but as a complex, adaptive system to be guided, and that shift in perspective is more important than any single percentage point drop in the 30 year mortgage rates.

What challenges are they anticipating? It’s not just a standard downturn. The data hints at deeper, structural changes. One analyst, Mark Zandi, noted that new AI technologies may be slowing down the hiring of entry-level workers. This isn’t a cyclical blip; it’s a technological transformation. Are we finally seeing an economic policy that looks forward at these massive shifts instead of just backward at last quarter’s inflation report?

Navigating the New Blueprint

Of course, not everyone shares this optimism. You’ll see headlines from pragmatic analysts at places like Zillow suggesting that current mortgage rates will likely remain confined to the 6-7% range for the rest of the year. Mark Zandi correctly points out that for many, housing affordability remains a massive hurdle. They’re not wrong. But I believe they're focusing on the altitude of the plane while missing the change in its flight plan.

The goal here isn’t a magical, overnight return to the 2.65% rates of 2021. That was an anomaly, a response to a once-in-a-century crisis. The new goal, the new blueprint, seems to be about building a more resilient foundation for the future. It’s about creating stability in an unstable world.

This is where the Fed’s actions connect to the 10-year U.S. Treasury market—in simpler terms, the global benchmark for long-term investor confidence. The Fed’s "insurance cuts" are a signal to that market, an attempt to broadcast stability and confidence. It’s like a pilot navigating turbulence. They aren’t trying to make the plane instantly teleport to its destination; they’re making a series of small, precise adjustments to ensure a smooth and safe journey through a rough patch. The dips in home mortgage rates today are those subtle, crucial adjustments.

This new approach, this proactive guidance, comes with immense responsibility. What if the "insurance" is bought too early, reigniting the very inflation we just fought so hard to tame? What crucial data points are we missing because a government shutdown has delayed reports on jobs and consumer prices? These are not trivial questions. The weight on the shoulders of these decision-makers is unimaginable.

But in this new landscape, something amazing is also happening: power is shifting. A recent Realtor.com study revealed that homebuyers can find an average 0.55% improvement in their mortgage rate just by shopping around. That’s not a rounding error; that’s a game-changer. In an era where a quarter-point from the Fed is front-page news, you—the individual—hold the power to achieve double that improvement on your own. It’s a quiet democratization of finance. While the system gets smarter, you get more powerful. Have you used a mortgage calculator recently to see what a half-point difference truly means for your monthly payment? The answer might just shock you.

The Dawn of the Proactive Economy

Forget the day-to-day market chatter for a moment. Step back and see the larger pattern. The real story isn’t that mortgage rates today are a little lower. The real story is that we may be at the dawn of a proactive, data-driven, and forward-looking economic era. We are witnessing a slow, deliberate pivot from a system of brute-force reactions to one of intelligent, anticipatory guidance. The numbers you see on your screen are just the first, faint signals of this monumental shift. The future of our economy won't be about avoiding every crash, but about building a system so resilient, so forward-thinking, that it can navigate the inevitable turbulence of progress with grace. And that is a future I am genuinely excited to see unfold.